cryptocurrency tax calculator australia

This means you can get your books. Income - Tradings GainsLosses Deductions.

11 Best Crypto Tax Calculators To Check Out

Yes you do need to pay tax on cryptocurrency in Australia.

. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual. Built to comply with Aussie tax standards. How to work out and report capital gains tax CGT on.

Find out how Australian crypto tax works in this detailed guide. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. Backed by global liquidity Cryptocurrency.

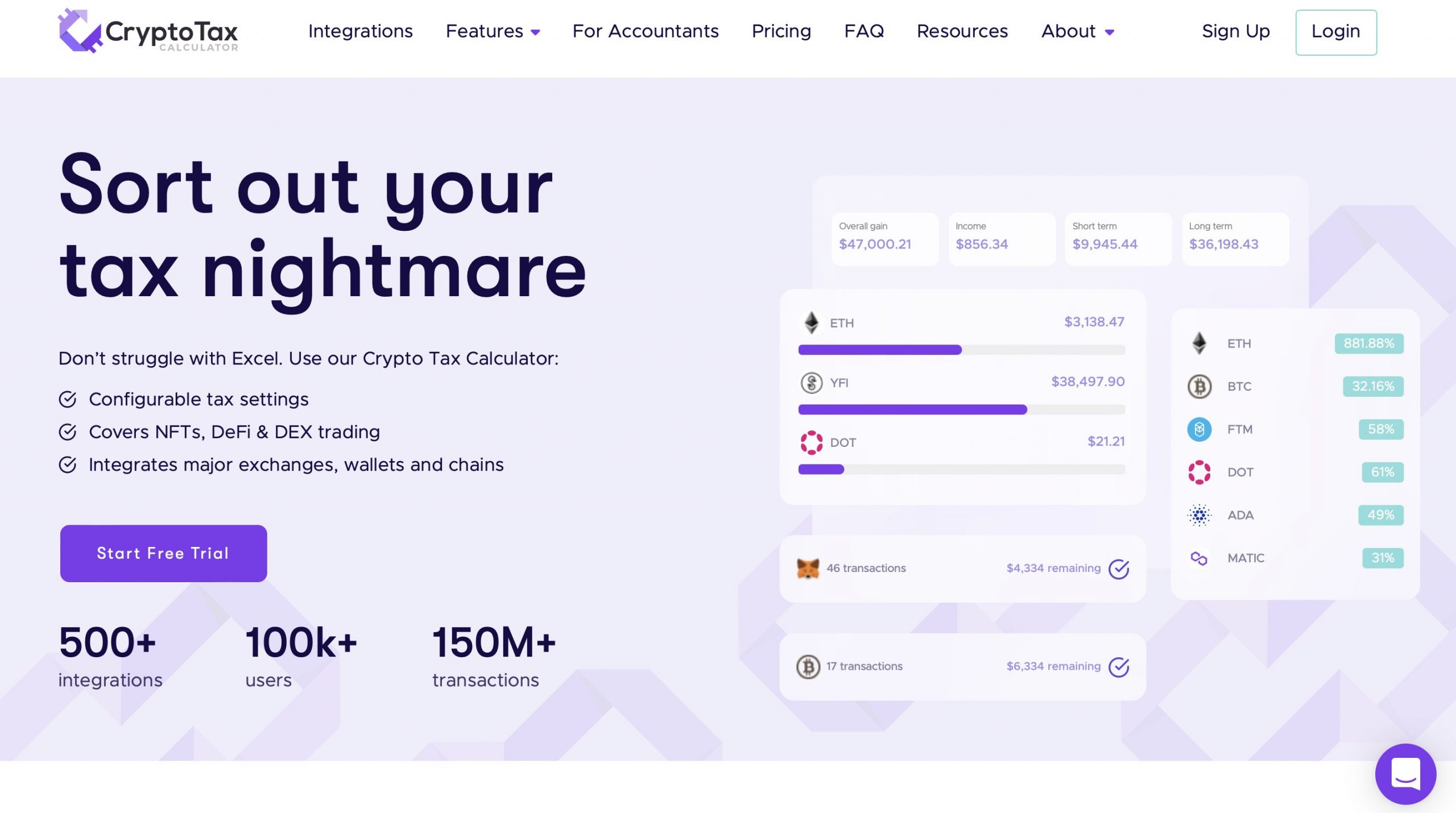

Overall Koinly is the best cryptocurrency tax software for Australians to stay compliant with the Australian Tax Office ATO. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Records may be requested at the discretion of the ATO and. Crypto Tax Calculator for Australia. As stated on the ATO website as of 29 June 2022.

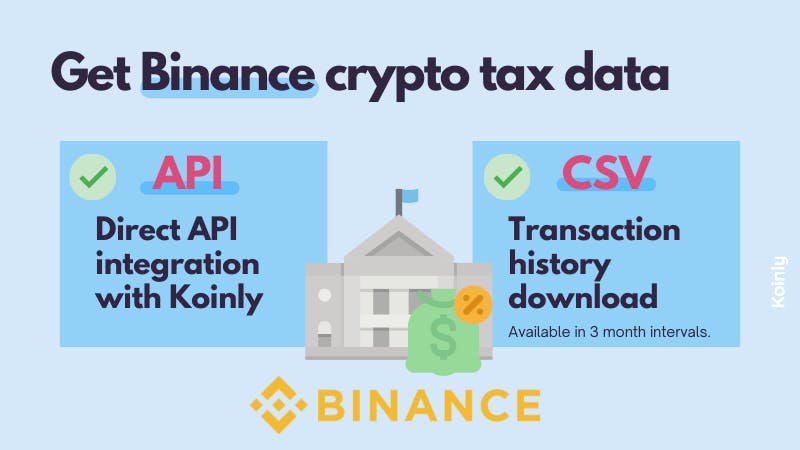

Activities that amount to crypto asset transactions and how to treat your crypto asset investments for tax purposes. You simply import all your transaction history and export your report. It provides users with an extremely user-friendly app which can be.

Sold price This is the total value in AUD. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you. At CryptoTaxCalculator we categorise future sales of cryptocurrency earned as income as capital gains with the cost.

Crypto income is declared on question 2 of Tax return for individuals 2022 NAT 2541. Crypto Tax Calculator Australia. If youve bought sold andor earned interest on cryptocurrency including non-fungible tokens NFTs during the financial year 1 July - 30 June youll need to declare your gains and losses.

Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes. Crypto Tax Calculator is a crypto tax. If your cryptocurrency trades are conducted through a company registered with.

Crypto Tax Calculator for Australia. Import your cryptocurrency data and calculate your. Quick simple and reliable.

For cryptocurrency traders the formula differs a bit. 19 tax on income between AU18201 to AU45000 which come to AU5092. Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

Youll need 2 forms one for income and one for capital gains. June 27 2022. Swyftx is an Australian owned and operated crypto exchange that allows users to buy Bitcoin Ethereum and 320 other crypto assets.

Therefore to accurately calculate your tax liability it is important to maintain records of all your cryptocurrency exchanges. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. The TokenTax Crypto tax calculator.

Free Crypto Tax Calculator Coinledger

Cryptoreports Google Workspace Marketplace

These Tools Will Help You Calculate Your Crypto Taxes Taxes Bitcoin News

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Crypto Tax Calculator Australia Cryptoaustralia Twitter

Crypto Tax Calculator Australia Cryptoaustralia Twitter

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Cryptocurrency Bitcoin Taxes Complete Tax Guide 2022

Next Steps Australia Crypto Tax Report Coinledger

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Top 10 Australian Exchanges For Crypto Taxes Koinly

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Crypto Tax Calculator Accointing Com

11 Best Crypto Tax Calculators To Check Out

Crypto Tax Calculator Australia How To Get Your Swyftx Csv File Youtube

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda